Looking for grounds to claim a tax deduction in your RV, the most common one is as a result of renting it out. Others include expenses incurred from using your RV for work or for a primary residence. But wait, there’s even more! Aside from tax-related deductions, you may also be eligible for concessions on your rego fees. So be sure to finish this blog.

Since 2020, the Caravan Industry Association of Australia (CIAA) has been working with the federal government for ways to support the tourism industry amidst the series of disasters that have hit the country. Some recommendations include tax reliefs, concessional loans and holiday-related tax deductions. So in April 2020, the government responded with various programs to give such support.

But with most of these temporary programs having ended already, the CIAA again pushes strategies to keep the tourism industry going. However, Australia’s 2021 budget focused on tax cuts for all workers and businesses in general.

It’s a given that Australia is widely known for its picture-perfect vacation spots, making tourism play a huge role in the country’s economy. Therefore, it’s unreasonable to neglect it until the COVID season completely rests. So while we have yet to see the enactment of CIAA’s proposed strategies, let’s maximise whatever support is available.

BLOG CONTENTS

Tax deduction pathways for RVers

- When you own an RV primarily for private use, but rent it out sometimes

- When you own an RV primarily for rent but use it sometimes for personal use

- Residents who primarily live in their own RVs

- Residents who use their RVs for work

Steps you must take to claim a tax deduction in your RV

What other benefits or discounts can I claim as an RV owner?

Summary on claiming tax deductions in your RV

Tax deduction pathways for RVers

There are many ways for you to claim a tax deduction as an owner. The thing is, of course, the total deductible amount depends on your exact circumstance. So here are the main ways to claim for RV tax deductions:

1. When you own an RV primarily for private use, but rent it out sometimes

Under the Australian Taxation Office’s (ATO) Peer-to-peer caravan and RV sharing deductions platform, you may claim tax deductions for expenses you incurred as a result of renting out your RV. Such rental must have been done on peer-to-peer platforms such as SHAREaCamper, Camplify, MyCaravan, Hire My Caravan or Camptoo.

Understandably, the challenge here is separating your RV expenses into personal-related and business-related. It requires you to be duly organised in your receipts and documents. So how is a tax deduction claimed in this case? Follow these three rules:

- Expenses directly related to RV rentals are 100% deductible.

These are the expenses you incurred as a result of using the peer-to-peer platform. Specific examples include your membership fee, listing fee and the platform’s commission. - Expenses that have to do with both personal and rental use are partly deductible.

Specifically, these are your RV’s registration fee, insurance fee, depreciation, cleaning fee and storage fee.

You apportion the deductible part by determining the time period your RV was actually hired. Meaning, the time when you posted your RV to be available for rent but was not actually hired, is counted as still for private use. - Expenses directly related to your personal use of the RV are NOT deductible

Other conditions

An RV that’s owned by two or more persons (as stated in the RV’s rego) must equally split the deductible tax. This is common for married couples. In such a case, you just compute your deductibles as described above and then divide it by the number of owners listed under the RV’s rego.

Lending your RV to friends or relatives (i.e. free of charge) is not considered as “for rent”.

However, if you rent out your RV to them at rates that are below the standard market prices – then you may deduct only up to the amount of income you earned from such rental.

Example #1

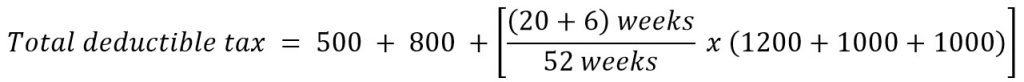

Gary and Ana own an RV and registered it for private use. Having realised that they use it for only 5 weeks a year, they decided to have it available for rent for the rest of the year. It so happened that some relatives of the couple wanted to hire the RV for 6 weeks. So Gary and Ana rented it out to them at below-market prices. In that same year, the RV was hired via the platform for a total of 20 weeks.

The below figures were used when it was time to make their claim for a tax deduction.

| DESCRIPTION | INCOME | EXPENSES |

| 1. Personal use (5 weeks) | 0 | to be apportioned based on #4 |

| 2. Peer-to-peer platform related transactions (20 weeks) | 14,000 | |

| Membership fee | 500 | |

| Listing fee / Commission | 800 | |

| 3. Rental of RV to relatives (6 weeks) | 2,520 | to be apportioned based on #4 |

| 4. General RV expenses | ||

| Registration fee | 1,200 | |

| Insurance fee | 1,000 | |

| Cleaning and storage fees | 1,000 |

Based on our data above, the total deductible tax is as follows:

Total deductible tax = $2,900

Therefore, Gary and Ana should include the following data when filing their respective tax returns:

- Other income = (14,000 + 2,520)/2 = $8,260

- Other deductions = 2,900/2 = $1,450

2. When you own an RV primarily for rent, but use it sometimes for personal use

The three rulings in #1 above apply in the same manner. The only difference is that you registered your RV(s) as “for rent”. Also, the time period when you did not use your RV for private use is counted as “for rent” period – meaning, a higher deduction rate compared to #1. However, these conditions must be met:

-

- You have actively and consistently (throughout the year) advertised your RV as for rent, especially during peak periods

- Make it available for rent it at a rate that’s competitive compared to other renters’

- The location and condition of the RV(s) are suitable for renting

- Refuse to rent your RV(s) only when there are enough grounds to do so

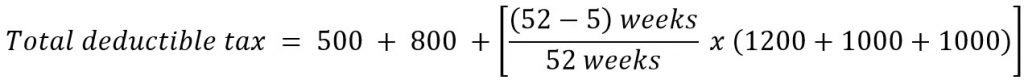

Example #2

So if Gary and Ana (from Example #1) registered their RV as for rent instead, we compute the tax deduction to be:

Total deductible tax = $4,192

NOTE: The 5 week period rented out to family members at below-market-rate may or may not be treated differently by the ATO.

| Disclaimer: | The examples serve only as a general guide to compute for your deductible tax. In no way are these absolute as you may have other expenses or circumstances that must be taken into consideration. Therefore, this is not tax advice and recommend you seek advice from a professional tax advisor. |

3. Residents who primarily live in their own RVs

With the continuous booming of technology, means for work have radically changed. Some businesses started to make working schedules flexible and have adapted remote work setups – whether in part or in full. These strategies remained to be optional for most businesses. But when the pandemic sprang, what started as considerations ended up as requirements.

The main reasons employed Australians worked from home in February 2021 were due to COVID-19 restrictions (12%) and the availability of flexible work arrangements (11%).

– Australian Bureau of Statistics

As far as I know, Aussies who primarily live in their own RVs can get some tax deductions as a result of not occupying a permanent home long-term. This would similar to having a home office, where a certain amount of expenses can be claimed based on usage or area dedicated to the office. I’m not a tax expert so I suggest that you talk with your tax adviser or accountant to learn more.

4. Residents who use their RVs for work

There are so many ways and conditions for which people use their RVs for work. Therefore, providing all those conditions is purely difficult (and taxing to read for you, if I may add). So I listed below only the common applicability and general conditions.

In case you want to know more about these, I recommend that you read BAN TACS’ Claim Your Trip Around Australia guide. It’s a good way to start with. But if you want to know the exact claimable tax deductions and real in-depth terms and conditions specific to your case, then it’s high time you consult a qualified professional.

But the basic protocol remains – that is, keeping all your documents and pieces of evidence organised in order to back up your claims. It’s worth emphasizing here the importance of consistently (and truthfully) filling in your logbook. Such diligence always proves to be useful later on.

a. Itinerant workers

No matter what the nature of your job is, as long as you use your RV to accomplish such a job, then you may claim tax deductions. The thing is that you must be an itinerant worker, in simple terms a “travelling worker”. Now, this does not mean that you have to have a white-collar job. The ATO states that:

The question of whether an employee’s work is itinerant is one of fact, to be determined according to individual circumstances. It is the nature of each individual’s duties not their occupation or industry that determines if they are engaged in itinerant work.

– Australian Taxation Office, Case S29 85 ATC 276

So in case, you plan to go fruit picking on various farms in Australia on a consecutive basis, then you’re qualified to have your expenses deducted from your tax. Some examples of such expenses include accommodation, meals, fuel and others. The same goes for shearers and other jobs that require you to constantly travel in your RV.

But here’s the catch:

-

- The claims on your RV travels must of course be related to the job you’re doing.

- Your itinerary must have been prepared beforehand. That means you are not allowed to look for work after getting done on the previous one.

- You must have more than one workplace listed in your itinerary.

- You must stay at a certain place for a certain period of time. And all in all, you must have been away from your permanent address for at least a certain period of time due to work.

b. Carrying heavy or large equipment

You may claim vehicle expenses as a tax deduction when your RV carries large or heavy (>18kg) tools or equipment that are essential to perform your job.

So how large is a “large equipment/tool”? It must be of the type that’s awkward or impossible to carry in your own person or in a public transportation vehicle, for example.

c. Home-based contractor

If you are a contractor using your home as your base of operations and your RV as your primary way of travelling to do your work, then you are allowed to claim such travel expenses as a tax deduction.

Steps you must take to claim a tax deduction in your RV

- After having determined your eligibility from the options I presented earlier, dig up all necessary documents that will back up your claims. These include your rego documents, receipts, work-related timesheets and others.

- Consult an accountant or any similar authorised person to help you confirm that your claims are valid and that you have enough evidence. Also, such person can help you sort out which are 100% deductible, partly deductible, and not deductible. This proves very useful if it’s your first time doing this. As you learn your way through, you may do things on your own later on.

- Contact the ATO to know the specific steps for lodging your claims. And it’s best if you lodge it in parallel with the filing of your tax return.

What other benefits or discounts can I claim as an RV owner?

Did you know that you can have discounts simply for owning an RV? Yes, you heard that right. When registering your RV, there are discounts that may apply to you – some of which include:

- Pensioners

- Veterans

- Senior citizens

- RVs that run on energy-efficient means (e.g. solar powered, gas or electric operated)

- RVs that are used in very limited areas

- And many others

You really don’t want to miss this out, right? Remember though that the availability and terms of such concessions vary per state, so do check the concession table I posted in another blog. You’ll find there all there is to know.

And even not as an RV owner, there might be certain deductions that are applicable to you. Check out the ATO’s 2021 guidelines for non-taxable amounts for full details.

Summary on how to claim a tax deduction in your RV

Claiming of such tax deduction is easiest for expenses that are related to renting out your RV. Then it gets tricky when it comes to claims related to using your RV as your primary home or your necessary means for accomplishing your job. The bottom line here is that you must consult first a qualified professional (e.g. accountant, legal advisor, etc.) before making any claims, especially on the tricky ones.

The stress is unimaginable when you prepare and file all your documents for tax deduction claims, only to find out that it’s not valid. On the other hand, you should consider if it’s worth paying a qualified professional for such claims. I’m not discrediting them of course. What I’m saying is that the amount of your claim might be less than your tax advisor’s consultation fee – so do look into that.

But as previously mentioned, claiming a tax deduction in your RV is not the only way to get ahold of benefits or discounts. Depending on your or your RV’s eligibility, you might be qualified for another type of benefit or discount. Great consolation, isn’t it?